CHASE MOBILE BANKING APP

An app designed to help users manage their daily medication

regimen by sending reminders for when to take their doses. It also provides information about potential side

effects and interactions with other medications so users can stay informed and never miss a dose.

(Student project)

ROLE

Product Designer

TIMELINE

1 month

* Part-time

20hr/week schedule

PROBLEM

Hidden costs derail travel budgets

International travelers struggle with financial uncertainty when making purchases abroad. Without real-time visibility into currency conversions and foreign transaction fees, users often discover unexpected charges after returning home. This lack of transparency leads to overspending, budget anxiety, and hesitation to use their Chase cards while traveling.

RESEARCH METHODOLOGIES

How I identified my users and their needs

To validate my assumptions and identify pain points in mobile banking for international travelers, I conducted user interviews with people who travel internationally. I wanted to understand people’s travel spending patterns, their experiences with mobile banking apps abroad, and their understanding around currency exchange information. I discovered that users frequently experience post-trip surprises about charges and not much real-time visibility into conversion rates. The interviews revealed a need for transparent, easy to find currency information and proactive fee disclosure during international transactions. This project also demanded a thorough understanding of foreign transaction fees and up-to-date currency exchange information, so secondary research to educate myself was necessary.

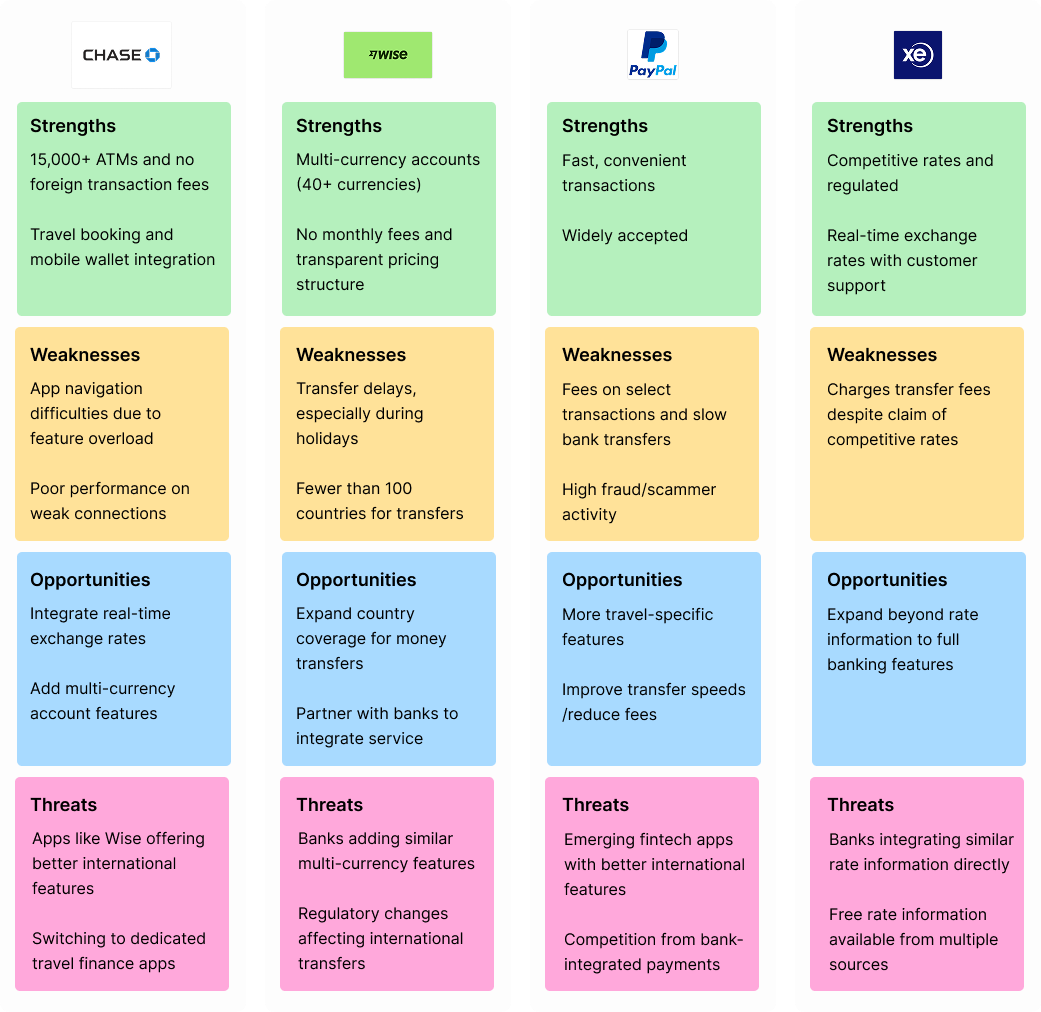

01 COMPETITIVE ANALYSIS

Taking a look at mobile banking app’s travel features

I analyzed Chase, Wise, PayPal, and XE Currency to understand their international features. While each offers basic currency services, traditional banking apps like Chase lack integrated real-time exchange rates and conversion tools. This forces travelers to juggle multiple apps, and creates an opportunity for Chase to build comprehensive international features directly into their platform.

Competitive Analysis

→

×

![]()

02 USER INTERVIEWS

The pain points of frequent travelers

I interviewed 5 frequent international travelers to understand their banking experiences abroad. Key findings revealed that users are uninformed about exchange rates and rely on Google for conversions, often discovering fees after transactions occur. Users want integrated currency calculators, real-time exchange rate information, and upfront fee transparency within their banking apps because they often feel that google isn’t always exactly accurate. The research confirmed that travelers currently juggle multiple tools and face post-trip surprises about costs, validating the need for a comprehensive international feature in banking apps.

AG

Always finds out after how much he's spent after the apple pay goes off. Never knows how much the exchange rate is.

BC

"Transaction fee is different all the time, it would be helpful if they could tell you exactly what it is."

RB

Get's charged fees while she's abroad. Not informed about the fees 'I'm losing money left and right.'

SF

Used debit card and figured out after the fact that her bank was charging her conversion fees.

JB

Looks up exchange rates before he goes to the country, but doesn’t feel like google is always accurate. Rates always seem to be a bit off.

SYNTHESIS

Insights gathered from users

From the interviews, I noticed that participants managed their finances well at home but struggled with financial awareness abroad. While some overspending may stem from a vacation mindset, the primary issue was lack of transparency, users couldn't accurately predict costs due to hidden fees and unclear exchange rates. This uncertainty led to post-trip surprises and "losing money left and right," as one participant described, rather than intentional overspending.

Affinity Map

→

KEY TAKEAWAYS

What I learned from my research

From the interviews, I noticed that participants managed their finances well at home but struggled with financial awareness abroad. While some overspending may stem from a vacation mindset, the primary issue was lack of transparency, users couldn't accurately predict costs due to hidden fees and unclear exchange rates. This uncertainty led to post-trip surprises and "losing money left and right," as one participant described, rather than intentional overspending.

Users consistently discover unexpected conversion fees and charges after returning home, with one participant noting they were "losing money left and right" without really understanding why.

Travelers rely on Google for quick conversions but struggle with real-time calculations, often finding out "after how much he's spent after the apple pay goes off." Some believe googling exchange rates doesn’t leave them with an accurate depiction of the currency difference

Users juggle multiple apps and manual calculations instead of having integrated currency tools, creating gaps in financial awareness while abroad.

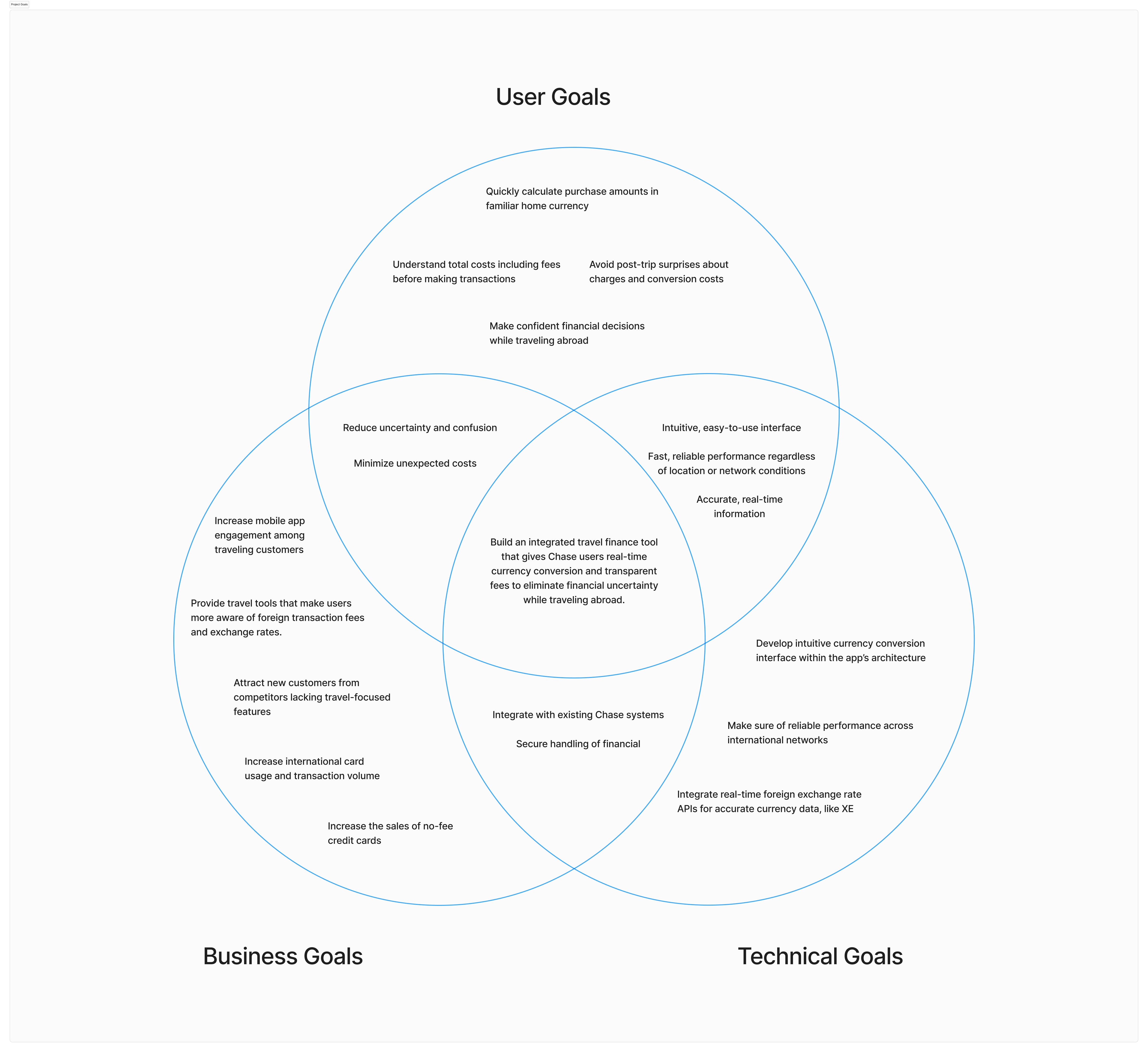

PROJECT GOALS

Aligning user needs and business requirements

From the interviews, I noticed that participants managed their finances well at home but struggled with financial awareness abroad. While some overspending may stem from a vacation mindset, the primary issue was lack of transparency, users couldn't accurately predict costs due to hidden fees and unclear exchange rates. This uncertainty led to post-trip surprises and "losing money left and right," as one participant described, rather than intentional overspending.

PROJECT GOAL

Build an integrated travel finance tool that gives Chase users real-time currency conversion and transparent fees to eliminate financial uncertainty while traveling abroad.

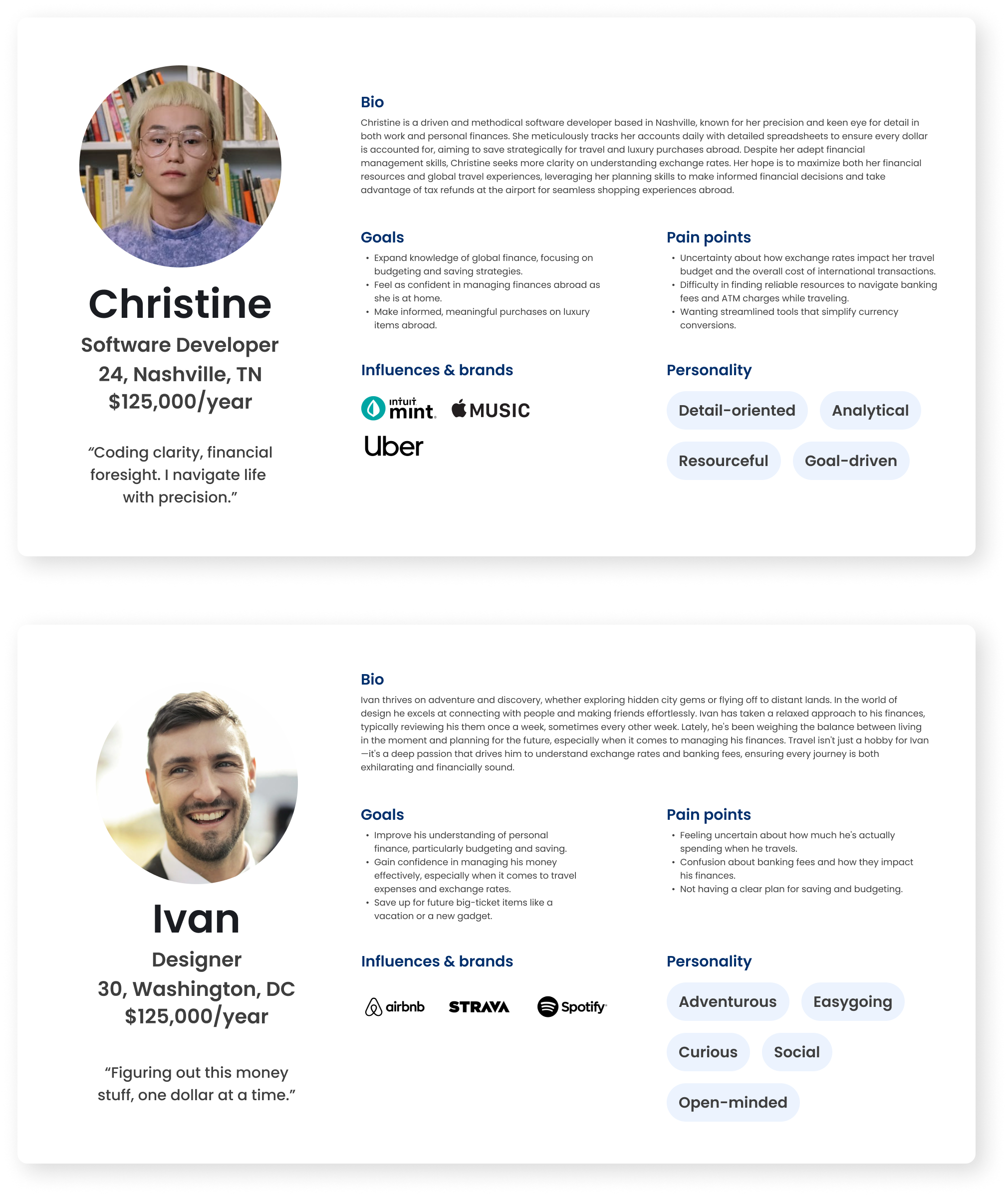

USER PERSONAS

Defining user personas and their pain points

Based on my interviews, I created two personas representing different financial management styles. Christine is a detail-oriented planner who tracks finances daily but struggles with international currency complexity. Ivan is a spontaneous traveler who checks finances weekly and prioritizes experiences over budgeting. Both share frustrations around exchange rate uncertainty and international fees, requiring solutions that address careful planners seeking precision and relaxed travelers wanting simple information.

POV & HMW STATEMENT

Defining the international banking challenge

Clear patterns from my research showed me that users would benefit from consolidated financial tools that eliminated guesswork surrounding foreign transaction fees and exchange rates. An added feature to the Chase Mobile Banking App that addresses these challenges could also help build users confidence when spending abroad without discovering unexpected costs after their trip.

POV

“I need transparent, up-to-date financial information at, or before, the point of purchase abroad. I want to feel as confident managing my finances abroad as I do at home, but I currently experience uncertainty about exchange rates and fees.”

HMW

How might we integrate a feature that provides real-time currency conversion and upfront fee transparency to eliminate financial uncertainty for travelers making purchases abroad?

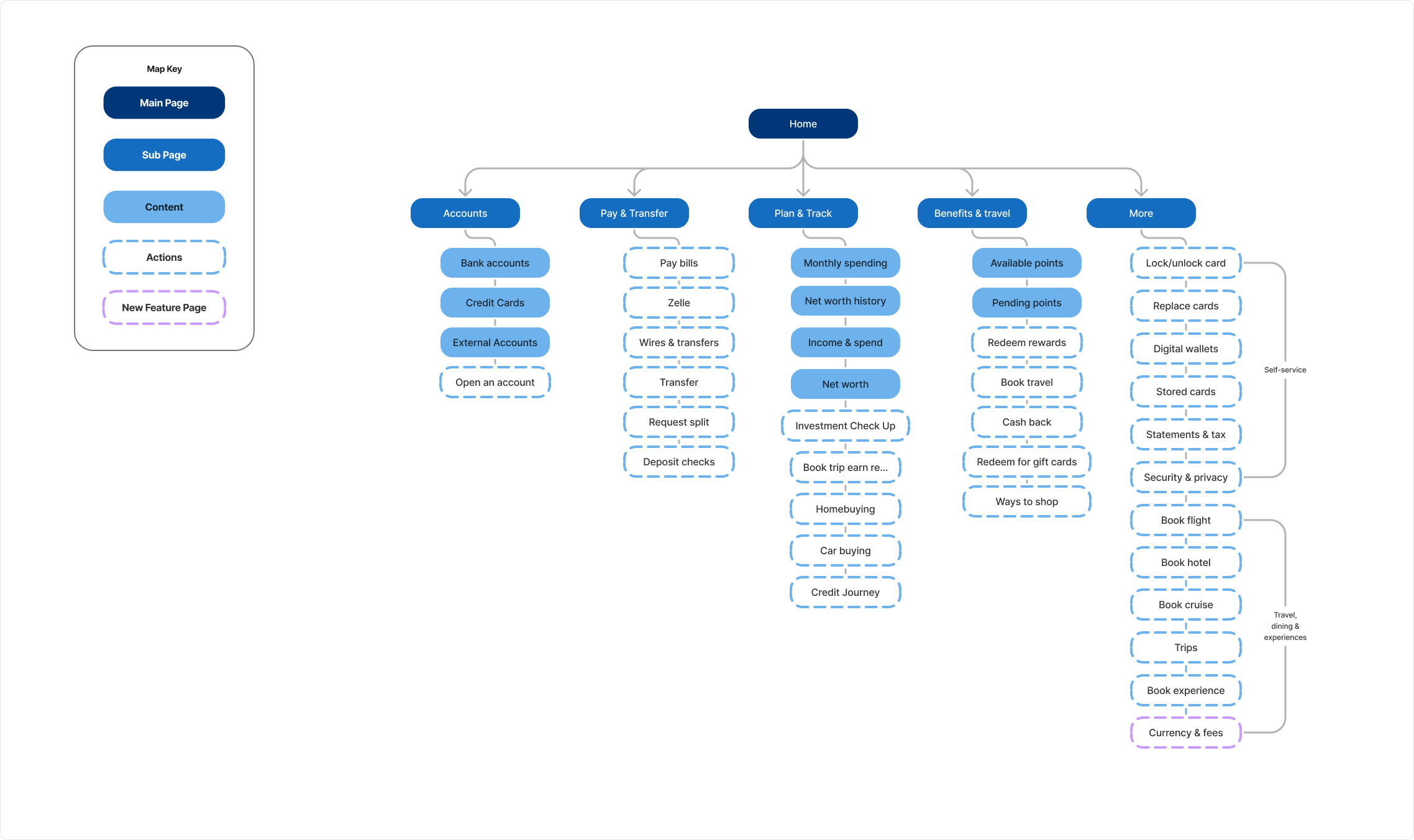

APP MAP

Where the new feature would live

I audited the Chase mobile banking app to map key pages and user actions, identifying a logical placement for the travel finance feature. The "Travel, dining, and experiences" section was the most logical integration point because it already serves users with travel-related activities.

App Map

→

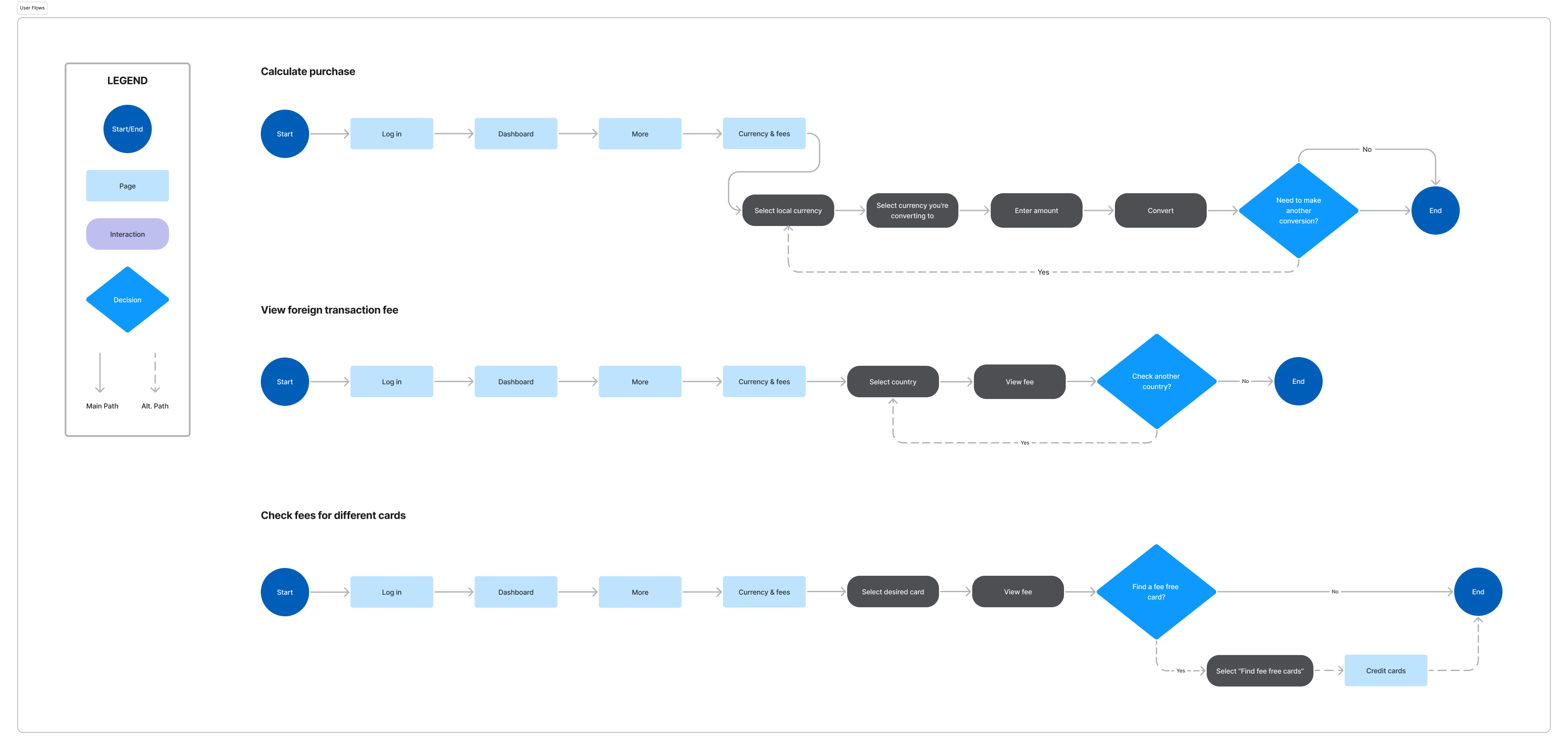

USER FLOWS

How users will navigate the new feature

To address the HMW question, I designed two primary user flows showing how travelers can calculate purchases and view foreign transaction fees based on their card and location. I also included an alternate path where users can explore fee-free cards, supporting the business goal of promoting Chase cards without foreign transaction fees to increase card sales.

User Flows

→

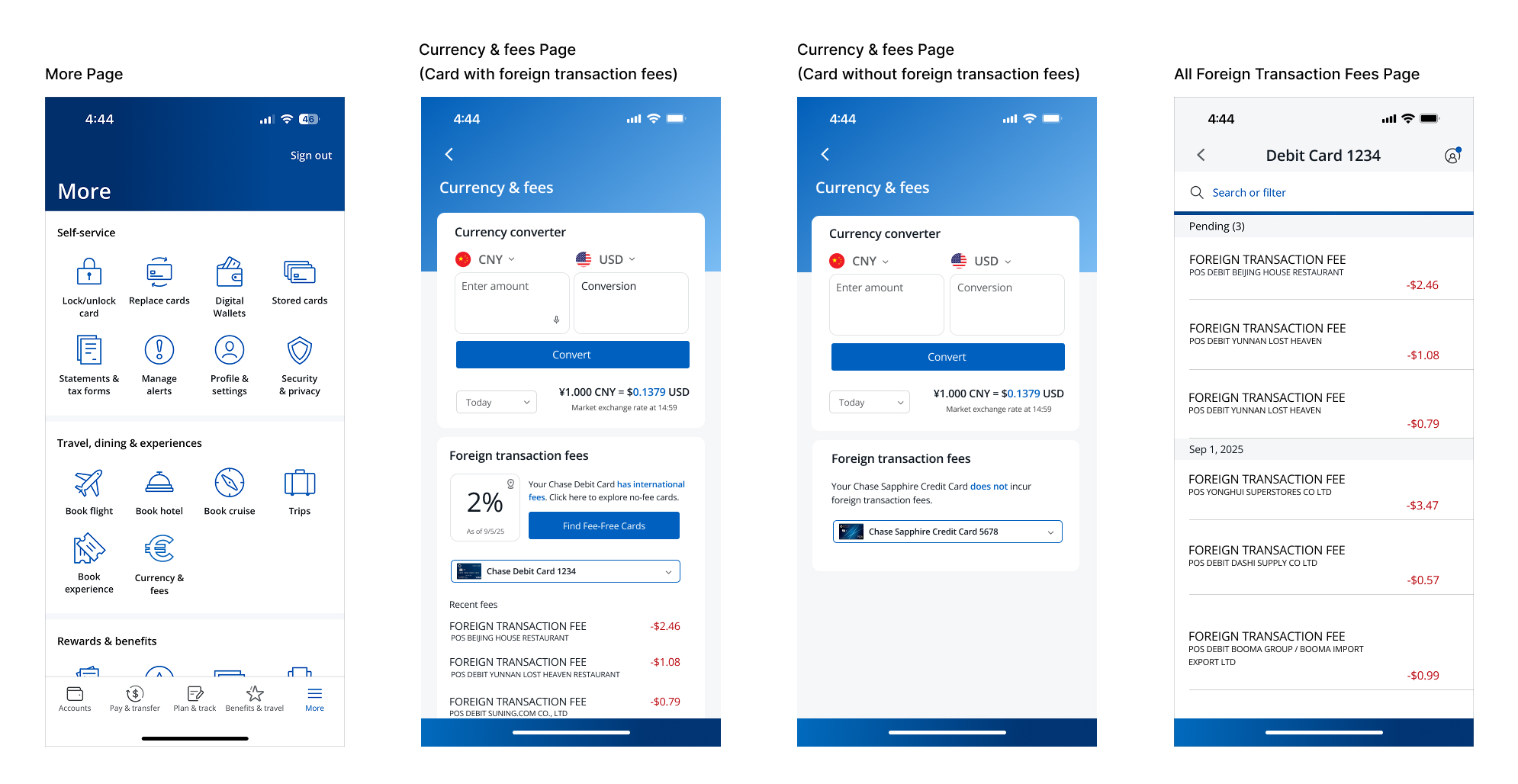

HIGH-FIDELITY WIREFRAMES

Final designs for the Currency & fees feature

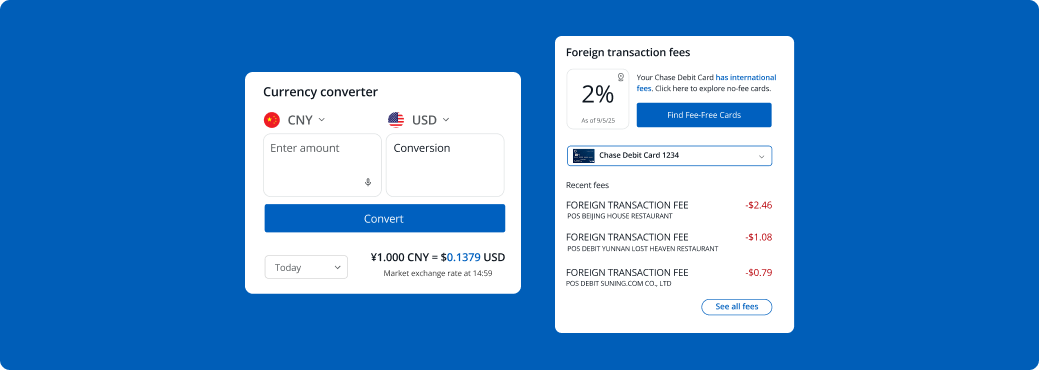

To save time, and since Chase already has an established brand identity, I skipped low-fidelity wireframes and branding work, moving directly into high-fidelity design. I replicated the UI on the mobile banking app to make sure the designs for the new feature were consistent with the existing design. The small number of screens required for this feature resulted in a quick project timeline. Below are all the pages that make up the new feature.

Users can access the feature by navigating to the "Currency & Fees" button in the "Travel & Dining" section on the "More" page. Here, they can convert currencies, check exchange rate history, and view foreign transaction fees based on their location and the fee history associated with their cards. Since not all Chase cards incur foreign transaction fees, I also included a screen view for cards with no fees to ensure clarity for all users.

High-Fidelity Wireframes

→

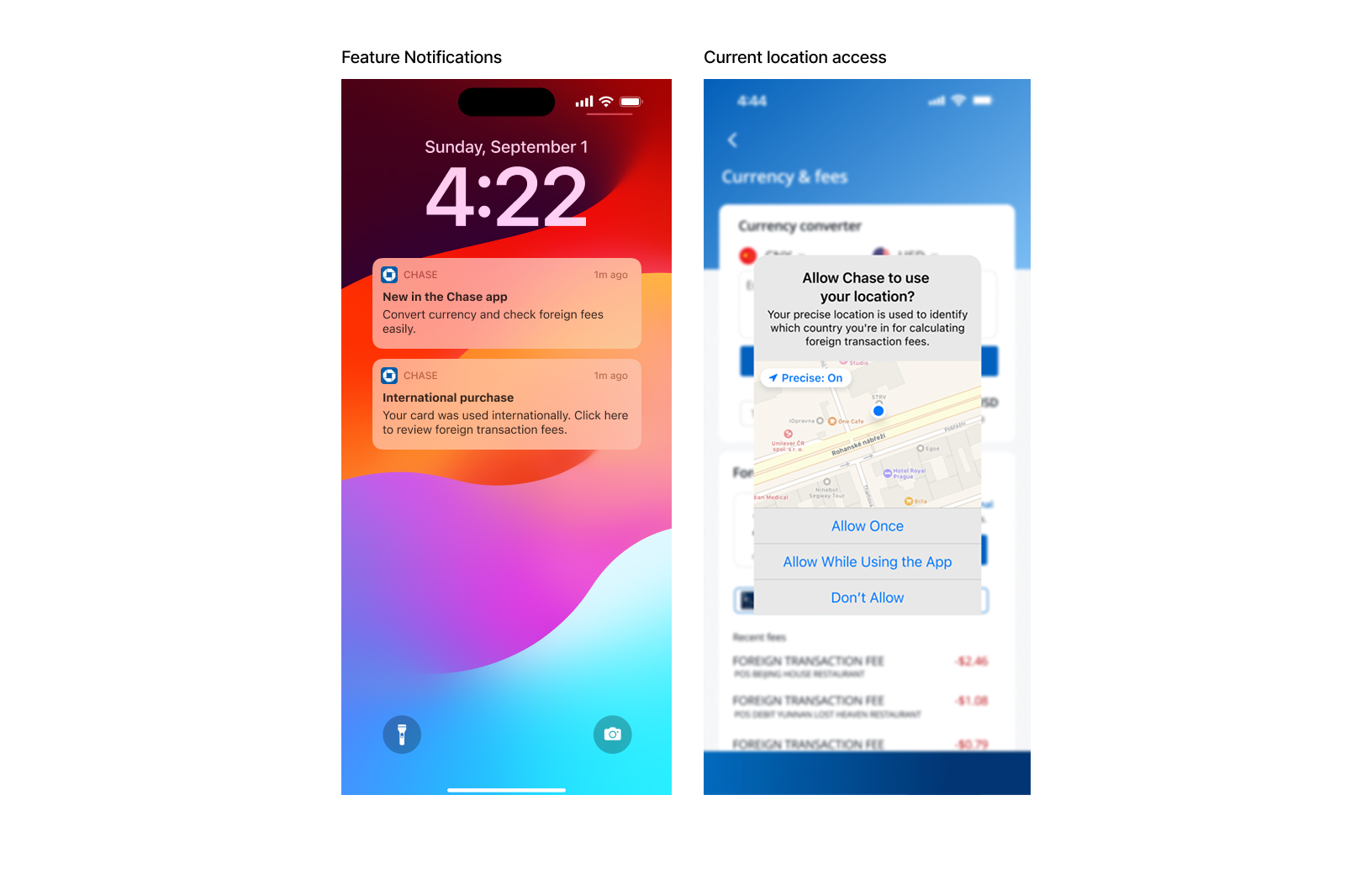

SOMETHING TO CONSIDER

Feature introduction and location-based alerts

As a new feature for Chase, it's important to consider how it will be introduced to users. The most effective approach would be to notify them directly through an app notification and provide alerts when they begin making purchases abroad. Additionally, users would be prompted to enable location services, allowing the app to automatically set their currency and see foreign transaction fee to the one that corresponds with their location.

TESTING

What works, what doesn’t

To evaluate the usability and ease of this new feature, I asked users to complete two tasks: converting a currency to their home currency and checking the amount charged in foreign transaction fees. While both tasks were straightforward for all users, there was common confusion about the meaning of the numbers in the foreign transaction fee section. Below are the user’s reactions and questions regarding the presentation of the foreign transaction fee charge display.

AG

“To my understanding the small black numbers could be sales tax or the difference in currency exchange”

BC

“That is the fee amount. I would suggest adding “fee” to make it incredibly clear”

SF

“Is this the current balance/available credit after purchase?”

JB

“Is this supposed to be the conversion rate?”

ITERATIONS

Changes made based on feedback

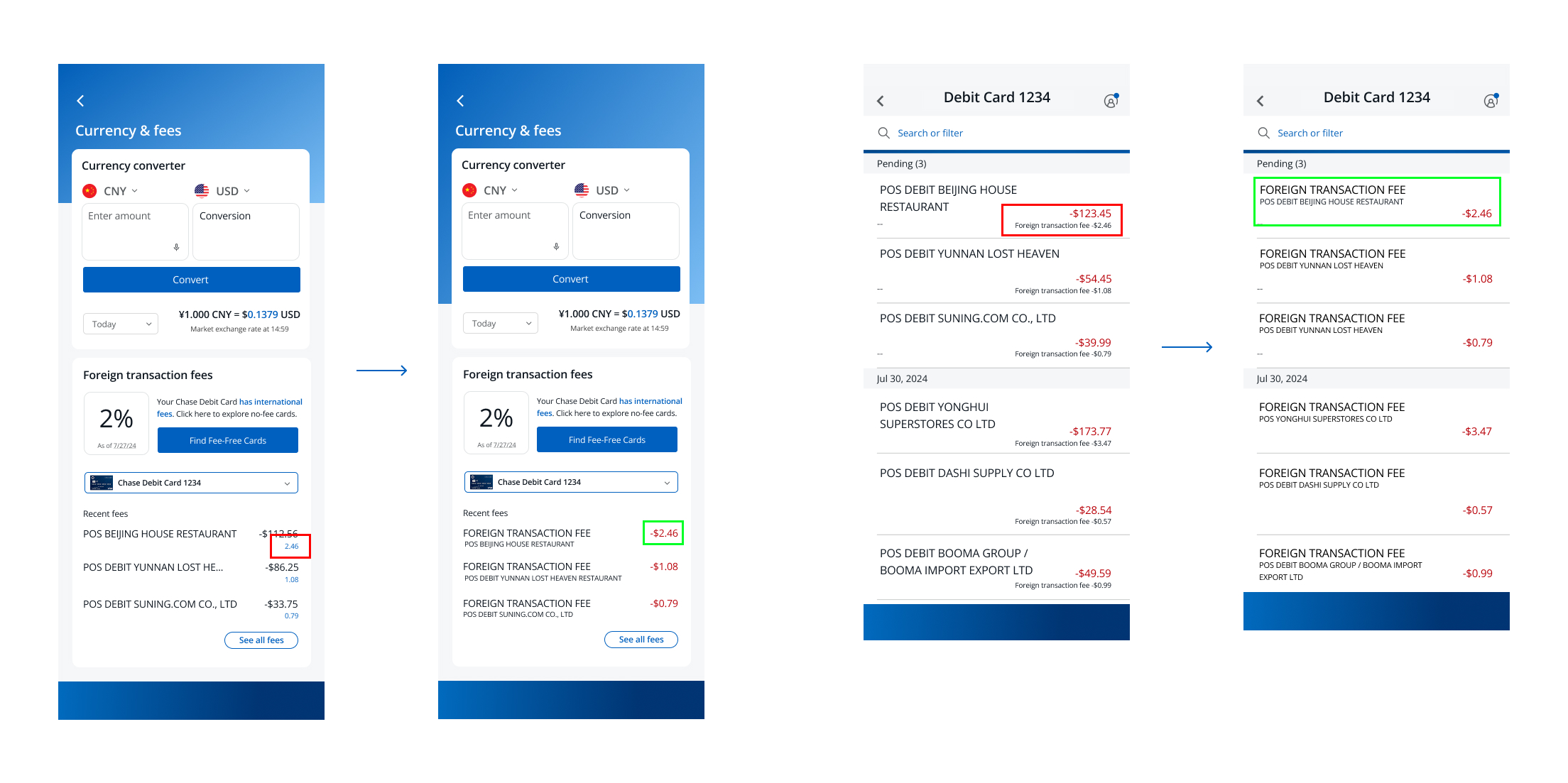

Once the feedback from the user testing was received, I went back to the wireframes and added their suggestions. Since there was confusion on what the small blue numbers meant underneath each transaction made abroad. I had to re-think the way these foreign transaction fee amounts were displayed.

To maintain consistency with other screens, I decided to label any deductions from the bank account in red. Additionally, I realized it was clearer to display only the foreign transaction fee amount to avoid any confusion that the fee was being subtracted from the original purchase amount.

Iterations

→

GOING FORWARD

What comes next

As I continue to develop and refine this project, I want to explore a few new additions: an AR currency converter to scan price tags using your camera and location-based suggestions on local spending norms and cost-saving tips.

↑